capital gains tax news canada

500 000 300 000 200 000. As you can see the end result shows that the increase in the capital gains inclusion rate to 75 increases the overall taxes by 1338.

How To File Your Income Taxes For Free Redflagdeals Com Income Tax Income Tax Return Tax Return

From a tax perspective heres a short list of things that our firm will be looking for.

. One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an equivalent fair market. For example on a capital gain of 10000 half of that or 5000. The Canadian federal budget has a release date.

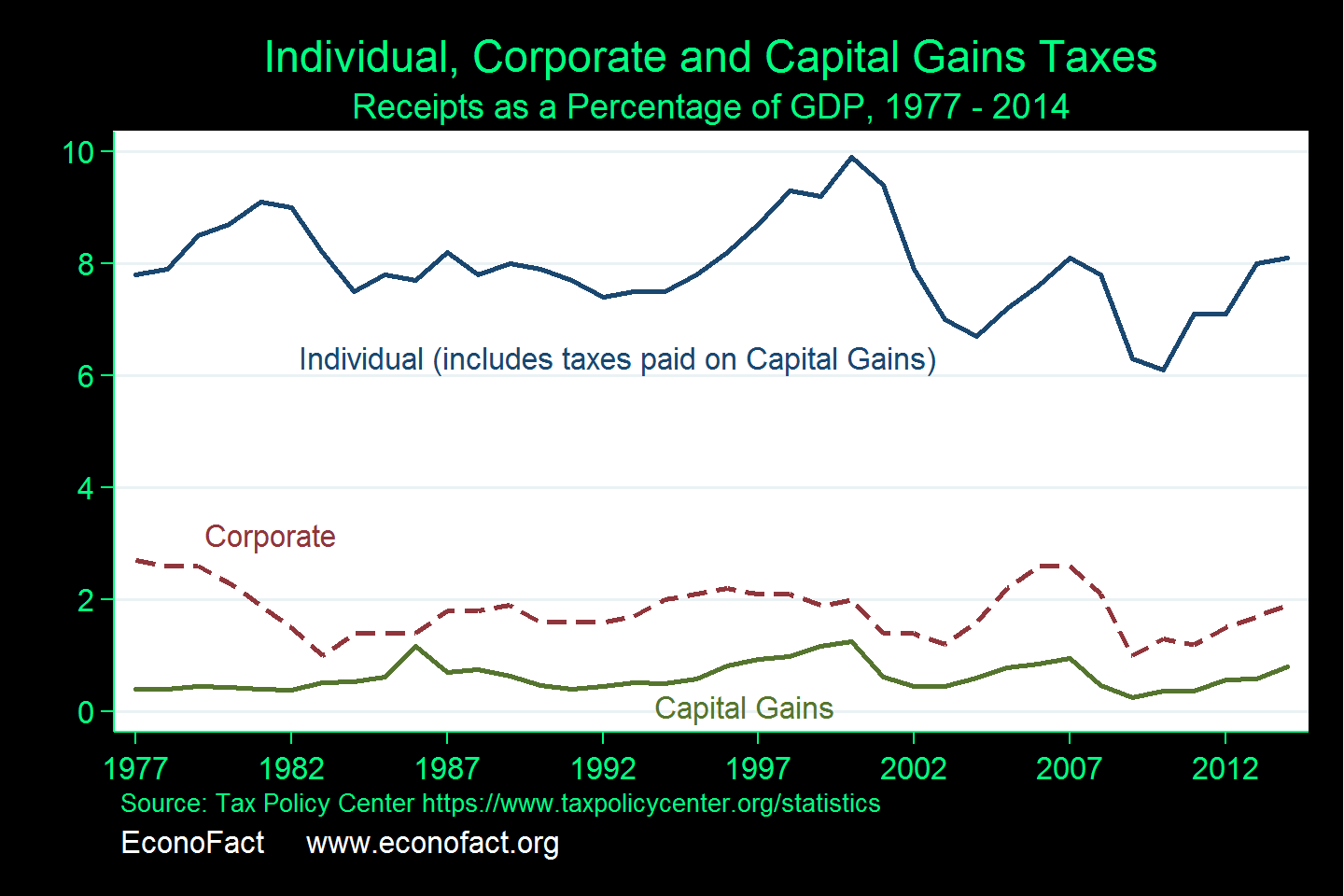

Reference is made to converting dividends into capital gains which are taxed at a lower rate. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Combined with a 38-per-cent surtax on investment income adopted in 2010 to help fund Barack Obamas health care law the Biden reforms would raise the top tax rate on capital gains to 434 per.

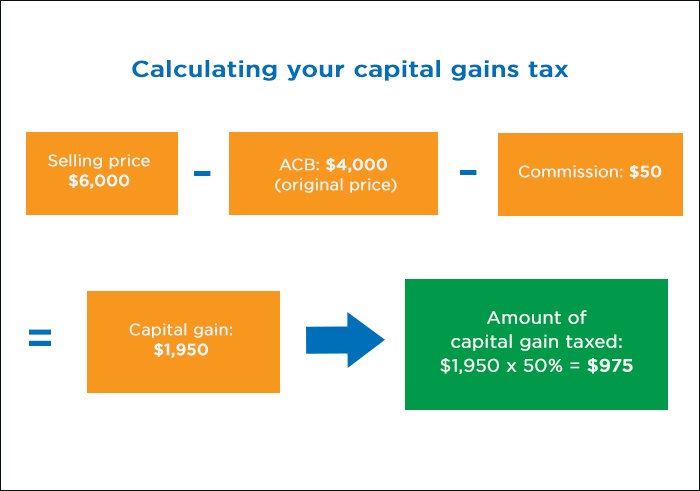

You must pay taxes on 50 of this gain at your marginal tax rate. From 1972 to 1988 Canadians. Since its more than your ACB you have a capital gain.

To calculate your Capital Gains all you need to do is subtract the original price you paid for your property from the price you sold it for. In Canada the capital gains inclusion rate is 50. To fix these problems the inclusion rate for capital gains should rise to 80 per cent from the current 50 per cent.

Canada Revenue Agency considers the use of social security as fifteen percent of a persons earnings. Your source for the latest Canadian tax news and updates on changing tax laws. Early last week the Conservatives called on the Trudeau Liberals to stop funding home tax studies and reject a proposal before cabinet to tax the capital gains on homes.

A 20 percent rate can be charged if the income is above that level. Claims of a capital gains tax on home sales CTV News. It was announced today that the budget will be released on the afternoon of April 7 2022.

Our recent study found that Canada ranks 22 nd out of 36 industrialized countries for our capital gains tax rate which at 27 is higher than key competitors including the United States 20 and. For the illustration above we have ignored the calculation of recapture of. Non-eligible dividends must be.

This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax. Your Capital Gains would be calculated as such. Published Thursday September 9 2021 1131PM EDT Last Updated Friday September 10 2021 1218AM EDT.

In Canada 50 of the value of any capital gains is taxable. Some interesting Canadian media commentary about the federal budget and what might be coming can be accessed here. In other words for every 100 of capital gains generated on a sale or a disposition there is an additional 1338 of tax owed.

The government had funded. The recent passage of Bill C-208 exacerbates these issues. NDPs proto-platform calls for levying.

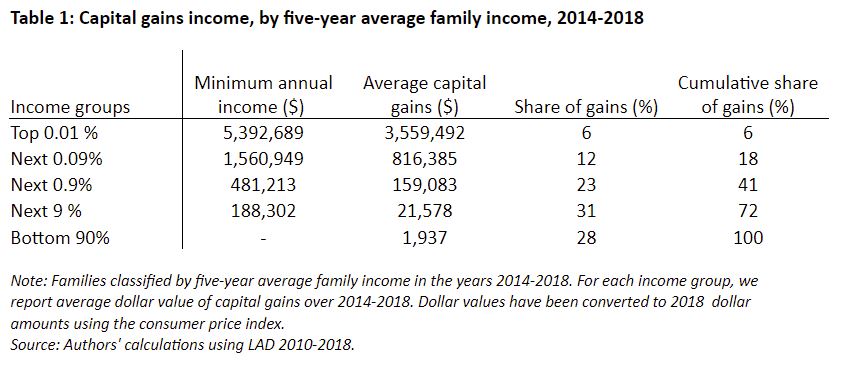

There are taxable portions of eligible dividends that can result in an additional 198 tax with a 87 surcharge. The origin of capital gains taxation in Canada can be traced to the Carter commission appointed in September 1962 to thoroughly review the Canadian tax system. The news keeps on getting better because youll only pay Capital Gains Tax on half your net capital gain each financial year in Canada.

In 1966 the commissions report recommended among other things that a tax be imposed on capital gains. On a capital gain of 50000 for instance only half of that amount 25000 is taxable. None of the plans put forward by Canadas main parties suggest lifting the capital gains exemption for principal residences with the exception of.

Working collaboratively with the Canada Revenue Agency CRA we aim to bring clarity on pressing tax questions and COVID-19 tax updates. Lets go back to our original example you originally bought the property for 300 000 and sold it for 500 000. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in.

In our example you would have to include 1325 2650 x 50 in your income. One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an equivalent fair market. The capital gains tax rate in Ontario for the highest income bracket is 2676.

The same risk presumably applies. And the tax rate depends on your income. When investors sell a capital property for more than they paid for it the Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount.

Canadas capital gains tax was introduced in part to finance the growing costs of Canadas social security system and to create a more equitable system of taxation. The sale price minus your ACB is the capital gain that youll need to pay tax on. The current tax preference for capital gains costs 35 billion annually with high-income families accruing most of the benefit.

Your sale price 3950- your ACB 13002650. The tax rate on capital gains is 15 percent but it is increased to 445850 for those with income between 40401 and 45850.

Capital Gains Tax Capital Gain Term

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

How Are Dividends Taxed Overview 2021 Tax Rates Examples

The Capital Gains Tax And Inflation Econofact

Capital Gains Tax What Is It When Do You Pay It

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

How To Calculate Capital Gains And Losses

How To Register For Vat In Uae Freezonesuae Is The Best Value Added Tax Consultants In Dubai They Provide Best Capital Gains Tax Inheritance Tax Indirect Tax

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

How High Are Capital Gains Taxes In Your State Tax Foundation

2022 Capital Gains Tax Rates In Europe Tax Foundation

Capital Gains Tax What It Is How It Works Seeking Alpha

Personalised 50th Birthday 1972 Newspaper Major Events Back In Etsy Australia In 2022 50th Birthday Happy Birthday Messages Happy Words

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants